+91 80 41281 383 • Srinivasam, No. 20, 9th Cross, 6th Main, Malleshwaram, Bengaluru

August'2022

Positive ![]() Negative

Negative ![]() Neutral

Neutral ![]()

| PARAMETERS, EVENTS | IMPACT | REASON |

| Inflation (CPI - India) | Inflation spiked to 7% in July'2022 from 6.71% reached in Jun'2022. Remains above RBI's upper tolerance level of 6%. | |

| Brent Crude | Brent crude prices corrected by -12% In Aug'2022 trading below $100. | |

| Currency INR USD | ₹ depreciated by 0.2% in Aug'2022, | |

| GDP | GDP growth of India is reported at 13.5% for Q1FY23, 3.8% absolute growth from pre-pandemic level. | |

| FII Inflows | FIIs were Net-Buyers of Indian equities to the tune of ₹51,204 Cr in Aug'2022. | |

| DII Inflows | DIIs sold ₹7,069 Cr worth of Indian equities in Aug'2022 | |

| G-Sec Yield | Yield declined to 7.18% from 7.24% in Aug'2022 end. | |

| Global - Inflation | US inflation has slightly cooled off at 8.5% in July'2022 from 9.1% in Jun'2022. |

| EQUITY MARKETS | IMPACT | REASON |

| Valuations-PE | It stood at 21.2 times in Aug'2022, 24.74% off from peak of the market in Oct'2021. | |

| Valuations-PB | It stood at 4.12 times in Aug'2022, 11.02% off from peak of the market in Oct'2021. | |

| Valuations-Market cap to GDP Ratio | Current market cap to GDP ratio is at 107%. It is above its long-term average of 81%. |

High Risk ![]() Moderate Risk

Moderate Risk ![]() Low Risk

Low Risk ![]()

| RISK FOR EQUITIES | LEVEL OF RISK |

| Geopolitical tension | |

| US FED - Tightening | |

| US FED - Interest rate hike | |

| RBI-Sucking out liquidity | |

| Current Valuations |

EVENTS, NATURE OF IMPACT & ANALYSIS

Indian equity continues to out per form YTD 2022

Indian equity market closed 3.5% up MoM in Aug. On YTD basis, Indian market continues to outperform all advanced economies as well as emerging countries except Brazil.

IMPACT: POSITIVE![]()

Remarks: India’s outperformance has to be understood in the backdrop of consistent FII outflows for 9 months period from Oct'2021. FIIs withdrew $33 billion in this 9-month period. Hence, the outperformance by the Indian markets is due to strong domestic flows, resilient economic prospects and growth despite global uncertainties and recovery of domestic consumption as well as investment cycle.

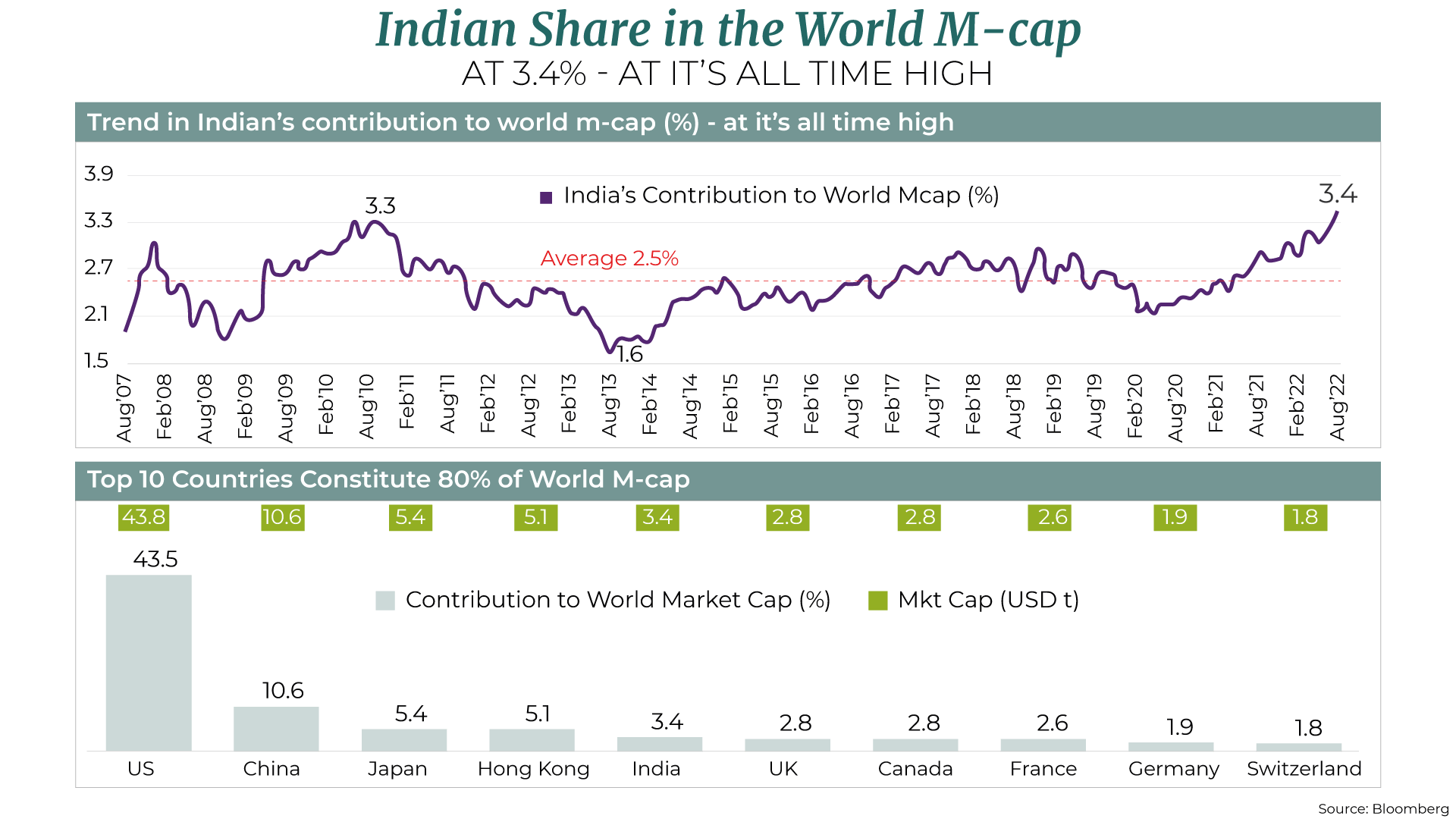

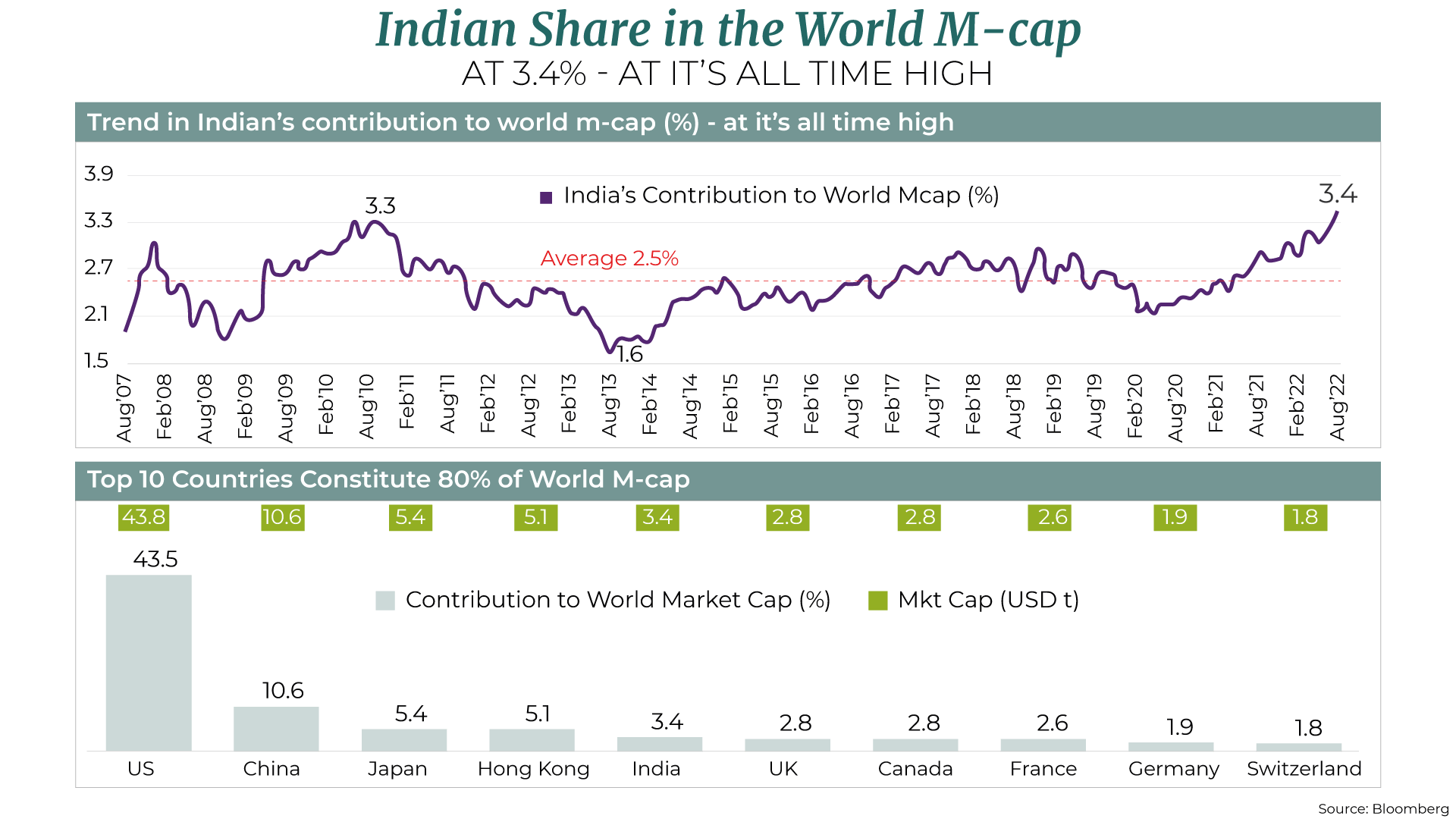

Due to this out performance, and the simultaneous underperformance of other major markets, India’s share in the world market cap has reached the all-time high 3.4% as against the average of 2.5%.

Indian equity continues to out perform YTD 2022

Indian equity market closed 3.5% up MoM in Aug. On YTD basis, Indian market continues to outperform all advanced economies as well as emerging countries except Brazil.

IMPACT: POSITIVE![]()

Remarks: India’s outperformance has to be understood in the backdrop of consistent FII outflows for 9 months period from Oct'2021. FIIs withdrew $33 billion in this 9-month period. Hence, the outperformance by the Indian markets is due to strong domestic flows, resilient economic prospects and growth despite global uncertainties and recovery of domestic consumption as well as investment cycle.

Due to this out performance, and the simultaneous underperformance of other major markets, India’s share in the world market cap has reached the all-time high 3.4% as against the average of 2.5%.

DIIs Turn Sellers after 17 months, FII inflows highest since Dec'2020

FIIs have turned bullish now whereas, DIIs seem to be booking partial profit after holding the market for 17 months.

IMPACT: NEUTRAL![]()

Remarks: In Aug'2022 – SENSEX reached 60k levels again for a few days and domestic investors booked partial profits. The same is visible in mutual fund inflow-outflow data. There is net-outflow from mutual funds in Aug'2022 but the ₹12000 Cr of SIP has continued in Aug'2022.

Credit growth at highest Level since Jul'2019

Non-food credit growth continued to witness strong momentum and is at its highest level since Jul'2019.

IMPACT: POSITIVE![]()

Remarks: Credit line grows when certainty & sustainability are visible. Post COVID, credit growth is picking up due to CapEx expansion and an uptick in corporate debt. Corporate credit cycle is expanding with bad loans under control and corporate balance sheets are largely deleveraged. It indicates a sustained recovery of the economy as well as a strong growth potential ahead.

India’s GDP Grows at 13.5% in Q1 FY22-23

India’s GDP grew 13.5% YoY in Q1 FY 22-23 vs Q1 FY 21-22.

IMPACT: POSITIVE![]()

Remarks: The growth rate of 13.5% is mainly due to a low base in the same quarter last year. If we consider the Pre-Covid GDP level as shown in the graph, it has grown a mere 3.8% since FY 2019-20.

However, the covid led economic slowdown was across the globe and from this perspective, Indian economy has recovered faster showing strong resilience as compared to other major economies.

Inflation is Cooling Off !

The base source data indicates the overall inflation slowing down.

IMPACT: POSITIVE![]()

Remarks: Currently, the headlines are high inflation across globe especially Europe and US. However, it seems to be peaking out. Caveat - Inflation data is delayed and we only know the data historically. This apart, inflation is always calculated YoY basis and along with downward movement of commodity prices & higher base effect, both will drive the inflation lower going forward in next 6 months. Lead indicators of inflation, being tracked on a daily basis (especially Crude, Steel, and other commodities except coal) show a downward trend.

The main risk to sustained inflation at current level is “sustainability of energy prices at current higher levels due to Russia-Ukraine war”.

What you should do. And should not.

![]()

Remain invested in equity in this current volatile market scenario.

![]()

Continue your investment

systematically in the way of SIP & STP.

![]()

Create Cash NOWif you need money in the short term.

![]()

There are opportunities in long-term debt, lock the fund for regular inflow.

![]()

Do not go all-in into equities in this highly volatile period. Add money on market dips. But do it in multiple tranches.

![]()

Conclusion:

Please remember investing is mostly backing quality businesses run by quality managements that offer a runway for strong cash flow growth, earnings potential, and long-term prospects. Buying them at a “reasonable” price with an eye on the returns is important. Stay invested, stay disciplined and secure your returns. We have prepared a sound long term holistic financial plan for you based on your risk profile, defined your financial goals along with you… did an asset allocation (with contingency plans built in) with you. We believe we are in the best objective position to help navigate the vagaries of the market.