+91 80 41281 383 • Srinivasam, No. 20, 9th Cross, 6th Main, Malleshwaram, Bengaluru

The history of insurance in India is more than thousands of years old. There is a mention of a concept in the Rig-Veda called “YOGAKSHEMA” which means security, prosperity, and well-being of people. Not only in Rig-Veda, but also in Arthashastra, Manusmrithi, and Dharmashastra insurance has been mentioned.

In those ancient times insurance generally denoted sharing of possessions that could have been re-distributed in the times of any kind of natural disasters such as floods, fire, famine, and epidemics. This was the initial form of modern-day life insurance history in India.

Life or Term Insurance and Health Insurance both play a pivotal role in our lives. When sky-high healthcare expenses bind us to be careful while planning financial decisions, choosing between Life and Health insurance is a task. They are both saviors during unexpected contingencies.

Life insurance ensures the security of your family in case of your accidental demise, while health insurance policy keeps you unaffected financially during a medical emergency. Since ill-health and death are inescapable, a health or life insurance plan should be included in one’s financial portfolio.

MIMI PARTHA SARATHY

Managing Director,

Sinhasi Consultants Pvt. Ltd.

Your financial plan must have a health insurance plan, which is the starting point of all financial plans and is also one of the best investment options.

Health insurance is a must, along with life insurance needs covered

Health is paramount as ill health will eat away your assets if not covered by insurance, since we will do anything from selling assets if required to save the lives of our loved ones, especially during these challenging COVID times. You need to take health insurance when you are healthy. This way, the premium will be lower than if we have any pre-existing disease which is common in India. Even before one starts investing towards one's goals, getting adequate health insurance coverage for oneself and family helps. Health insurance takes care of your unplanned expenses that may arise due to a medical contingency, even those that lead to hospitalization.

Source: India Today

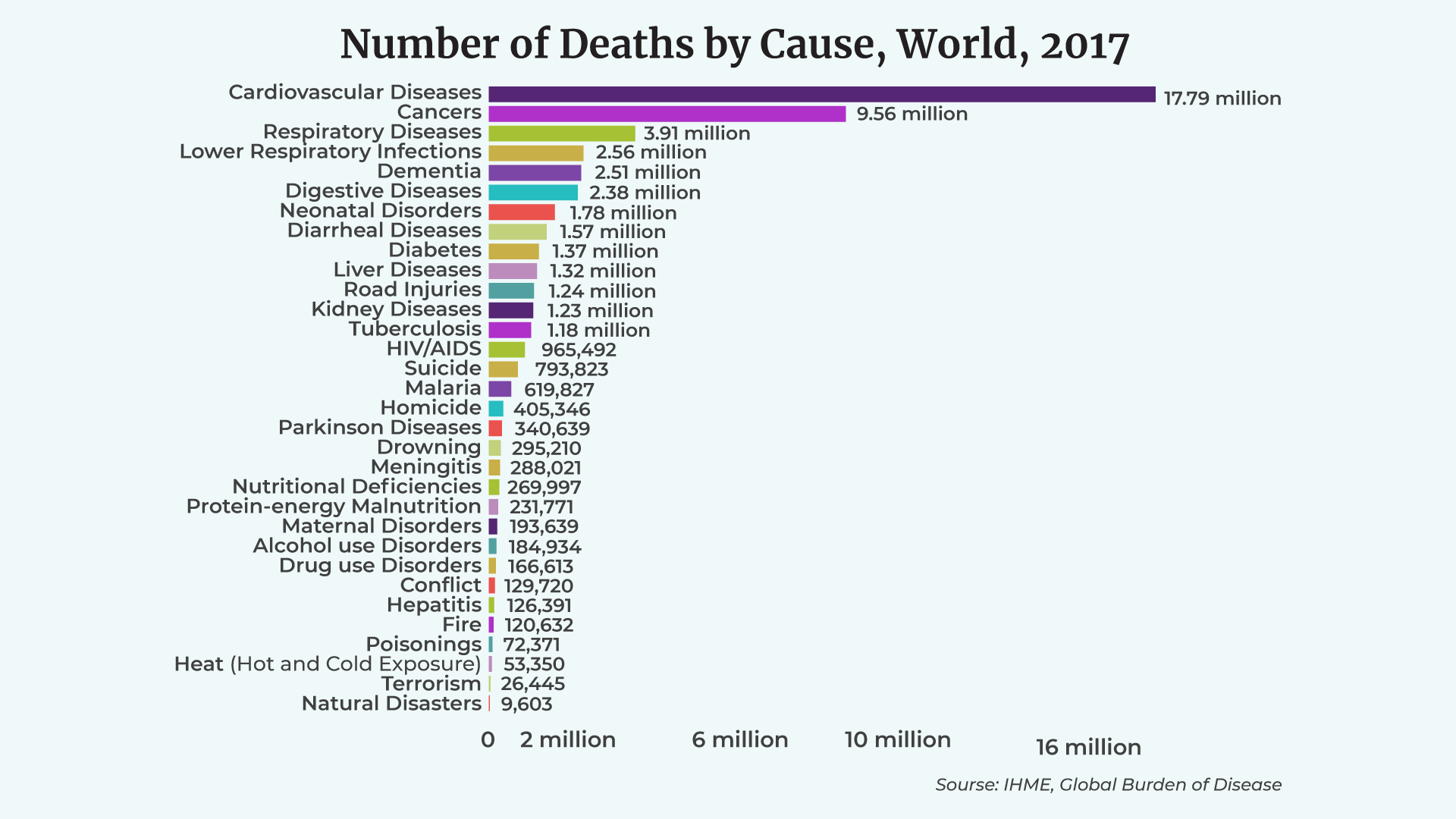

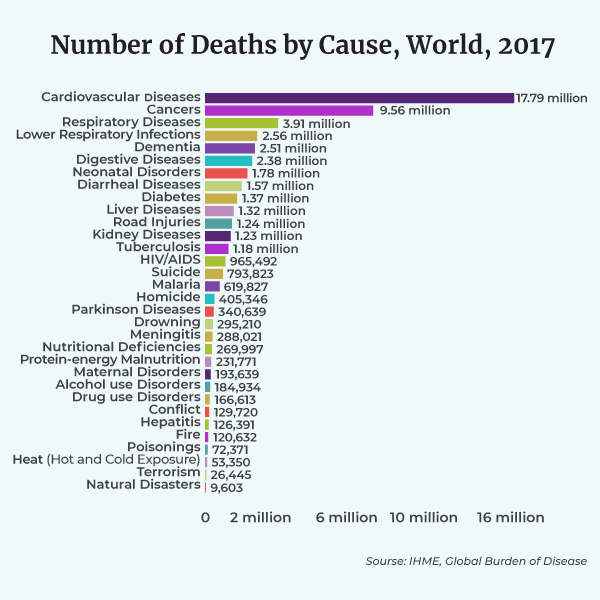

Health emergencies are common these days. With the hustle and bustle of life, we often tend to ignore our health and are prone to more lifestyle diseases. Medical emergencies lead to hefty hospital bills that may adversely affect your savings. So, having health insurance is a must these days. When you know your financial expenses will be taken care, you don’t compromise the quality of healthcare.

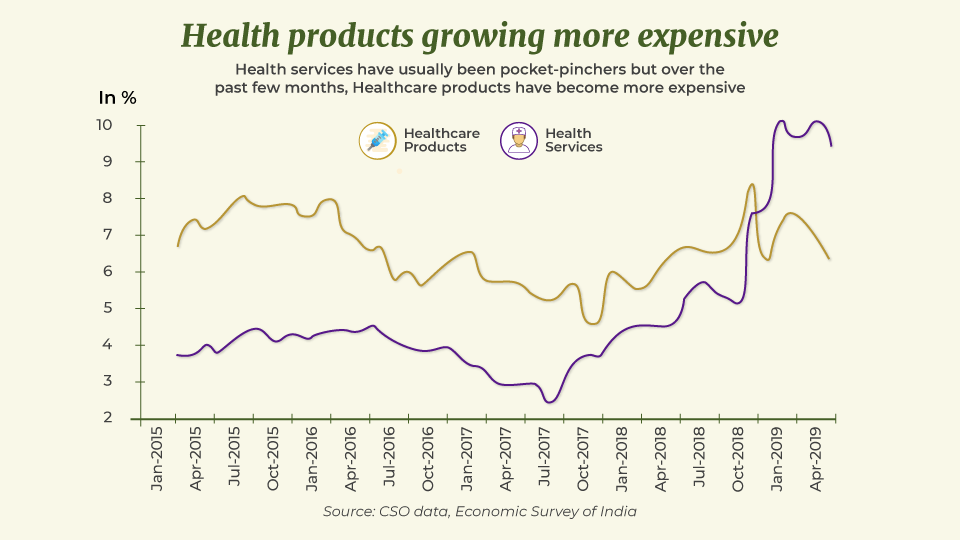

Medical expenses are skyrocketing. The increasing trend in healthcare expenses binds us to have an adequate health plan that covers you against health care (medical) inflation that stands at 14% in 2023.

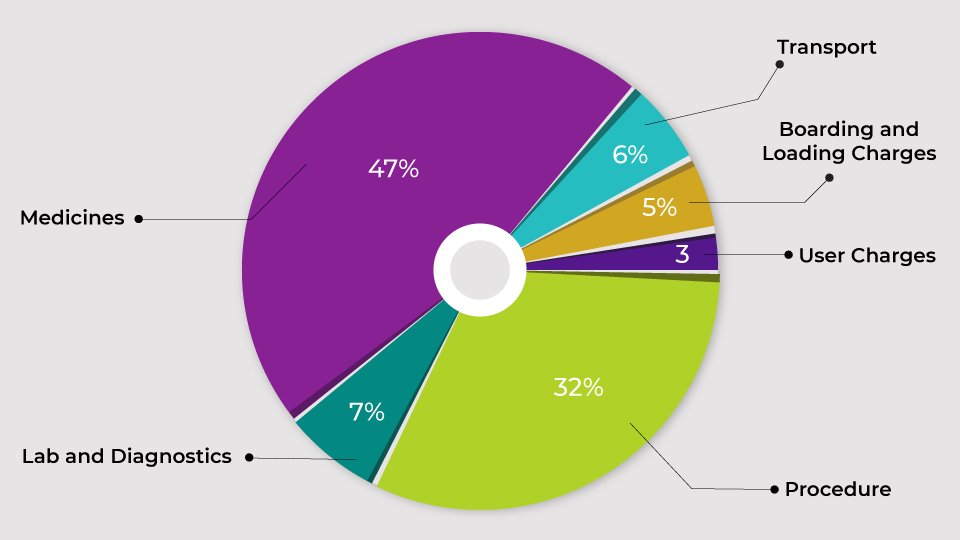

Why do you need health insurance? Is it more than just hospitalisation coverage? In India, health insurers cover you starting from the medical expenses including room rent, doctor’s bill, surgery, ambulance, maternity expenses, Ayurvedic treatments, prescription costs, etc. This is just the tip of the iceberg. It provides for enough coverage that fulfils almost your overall medical needs.

While choosing a health cover, one should ideally start by comparing plans from 2-3 preferred insurers. Have a close look at the inclusions and exclusions in the most basic plan being offered by them. Do not base your decision solely on the premium, instead prefer simple plans with fewer conditions and restrictions. And remember, every member of the family, irrespective of the age, needs health insurance cover to tide over unforeseen medical exigencies anytime in the future.

Life insurance is designed in a way that provides financial protection to one’s family in the event of his/her sudden death. It pays a lump sum amount, which is pre-decided. Here’s why you should go for Life.

Life insurance is designed in a way that provides financial protection to one’s family in the event of his/her sudden death. It pays a lump sum amount, which is pre-decided. Here’s why you should go for Life.

The sudden demise of the sole earner of a family leads to loss of income and hence, marks a considerable financial strain on their survival. If the insured has a life insurance plan, their family members can ask for a death claim to be paid by the insurance company. This much-needed financial assistance helps the family to survive or to start afresh.

Most insurance companies have a provision to structure pension plans. This plan can take care of your expenses post-retirement. It runs on annuity payments at regular intervals. This way you can secure an income for your golden years.

Apart from providing death coverage, some life insurance plans also offer maturity benefits. At the maturity of the plan, the investor can avail of the money. In this way, by creating investment options, it affords a corpus in a specific period. Besides, for those who buy ULIPs (Unit Linked Insurance Plans), the premium paid can be invested in the share market. This way one can enjoy market-linked returns as well, with the life cover creating the best investment option.

Paying the periodic premium for your life insurance cover ensures some percentage of income goes into the practice of saving. This will earn you a corpus in the long run, which is, by any means, bigger than what you invested as savings.

The amount paid as a premium of up to 1.5 lakh, is exempted from the tax deduction. This provides an avenue for tax-free investment and hence forms an important part of avenues of tax planning. Read More.

In conclusion, you must realize it is not an either-or situation. Both of these tools are important resources in your investment planning.